Abstract

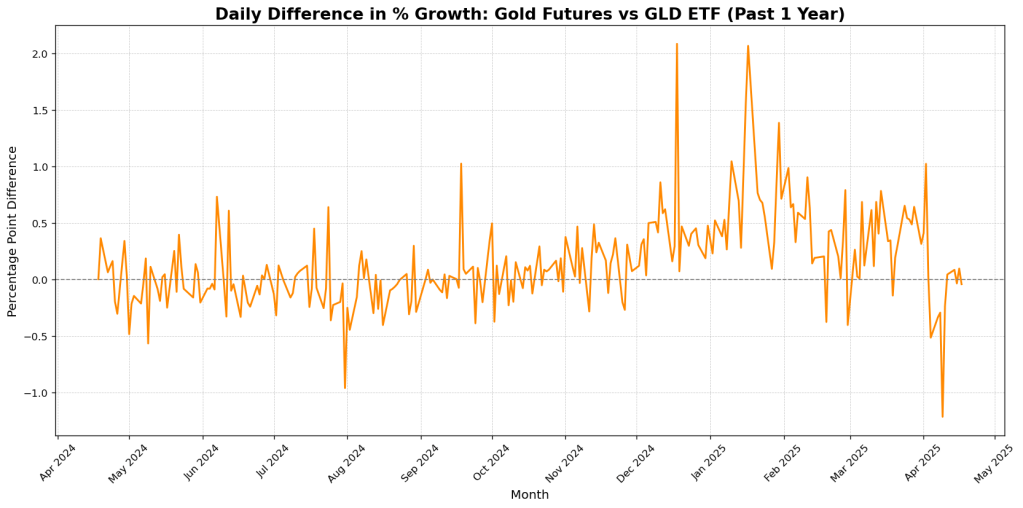

This paper investigates the percentage price changes and divergence between Gold Futures and the GLD ETF from April 2024 to April 2025. By exploring notable macroeconomic developments and analyzing daily percentage differences, we aim to understand the implications of global economic events on gold price behavior and ETF tracking accuracy.

1. Introduction

Gold has long been viewed as a safe haven asset, especially in times of economic and geopolitical uncertainty. Exchange-traded funds (ETFs) such as SPDR Gold Shares (GLD) offer a proxy to physical gold investments, while gold futures represent market expectations of future gold prices. This paper compares daily percentage changes in gold futures and GLD ETF prices over a one-year period from April 2024 to April 2025, identifying fluctuations and relating them to macroeconomic developments.

2. Methodology

We collected daily price data for gold futures and the GLD ETF from Yahoo Finance. The prices were normalized to a common base on April 18, 2024. Percentage changes were computed relative to the base value. We then calculated the daily percentage point difference between the gold futures and the ETF to assess the strength and volatility of their tracking relationship.

3. Findings and Analysis

Between April 2024 and April 2025, gold markets experienced notable volatility amid a shifting global macroeconomic landscape. This report investigates trends in Gold Futures and the GLD ETF, examining both their individual price paths and the percentage point difference between them. While these two typically move together, their divergences over the past year reveal key insights into investor sentiment, market structure, and macroeconomic catalysts.

1. Understanding the Gold Futures vs. GLD ETF Spread

While both Gold Futures and the GLD ETF track the price of gold, differences arise due to:

– Futures market structure: Futures embed expectations about future prices, interest rates, and storage costs.

– ETF mechanics: GLD reflects spot gold with management fees and tracks daily NAV via physical gold holdings.

– Liquidity & trading hours: Futures trade nearly 24/7, while GLD trades only during U.S. equity market hours.

– Investor demand: Speculative futures flows vs. ETF inflows by long-term investors can cause temporary dislocations.

By tracking the daily percentage point difference between these instruments, we gain insight into how investors react to macro news and risk sentiment shifts.

2. Key Periods of Divergence and Macroeconomic Drivers

Late April – Early May 2024: Futures Discount Widens

Spread range: -0.49% to 0.16%

Event: Renewed hawkish Fed commentary led to a futures discount.

Analysis: Futures lagged GLD slightly as expectations of rate hikes pressured short-term gold outlook. Traders positioned for weaker gold via futures while ETF holders stayed passive, creating a minor divergence.

Mid-June 2024: GLD Outperforms Futures

Spread spike: +0.61% on June 12

Event: Mixed inflation data and soft retail sales

Analysis: While futures initially reacted to dovish expectations, GLD held steady. The rally in GLD possibly reflected longer-term investor confidence, creating a divergence as futures traders unwound short-term positions more rapidly.

Late July 2024: Futures Premium Re-emerges

Spread spike: +0.64% on July 24

Event: Signs of Fed pause + geopolitical headlines

Analysis: Futures traders began pricing in Fed dovishness more aggressively than ETF investors, who tend to lag. The premium reflected expectations of upcoming monetary easing before it was reflected in the spot market and ETFs.

Early September 2024: Convergence and Flat Spread

Spread near 0%: September 3–6

Event: Rate cut confirmed by the Fed

Analysis: With the Fed’s cut already priced in, both instruments aligned more closely. This period of calm reflects reduced speculative divergence.

Mid-October 2024: Futures Premium Climbs Again

Spread highs: +0.49% on Oct 1

Event: Trade tensions with China escalate (U.S. tariffs on critical minerals)

Analysis: Futures quickly priced in the geopolitical risk and gold’s safe-haven role. The spread widened as ETF adjustments lagged in response to longer investor reallocation windows.

Late December 2024: Major Divergence

Spread peak: +2.08% on Dec 18

Event: Powell’s speech warning of inflation from tariffs + volatile bond markets

Analysis: A sharp rally in futures reflected panic buying for short-term protection. GLD lagged as ETF inflows take time to adjust, exposing a dislocation between speculative and physical demand.

Mid-January 2025: Elevated Spread Persists

Spread spike: +2.07% on Jan 17

Event: Continued China-U.S. retaliation on trade and weak industrial output

Analysis: Futures stayed at a premium as market priced in extended global economic slowdown. Persistent spread suggests ETF buyers were slower to respond or already heavily allocated to gold.

Early April 2025: Brief Futures Discount

Spread low: -1.22% on Apr 9

Event: Technical correction and U.S. dollar rebound

Analysis: GLD briefly outpaced futures—possibly due to rebalancing and redemptions in futures markets. A strong dollar may have triggered leveraged futures liquidation while GLD held firmer.

3. Macro Trends Reinforcing Gold’s Strength

Throughout the year, several global forces shaped gold prices and their expression through different instruments:

| Macro Factor | Impact on Gold/Futures-ETF Spread |

| Fed rate cuts | Supported both instruments, futures responded faster (spread widened) |

| Geopolitical tensions | Prompted safe-haven demand; futures reacted first, ETFs caught up later |

| Bond market volatility | Boosted gold appeal as real yields fell; futures saw speculative inflows |

| Central bank buying | Long-term demand supported GLD more than futures (converging effect) |

| Commodities volatility | Lifted gold broadly as inflation hedge; futures more sensitive to sentiment |

4. Conclusion and Outlook

The divergence between Gold Futures and the GLD ETF offers a real-time lens into investor psychology. Periods of widening spreads generally occurred around central bank actions and geopolitical flare-ups, as futures markets digested news more quickly than ETF flows. Conversely, convergence followed when macro narratives stabilized or news was fully priced in.

Looking ahead:

– With tariffs and trade tensions escalating, continued spread volatility is likely.

– If rate cuts deepen, both instruments should rally, though futures may temporarily overshoot.

– Watch for sudden spikes in spread as leading indicators of short-term market shifts or sentiment misalignment.

4. Conclusion

Our analysis highlights a mostly tight tracking relationship between gold futures and GLD, with deviations arising in periods of market volatility or during macroeconomic announcements. Significant events such as central bank interest rate decisions, inflation surprises, geopolitical tensions, and changes in ETF composition all contributed to fluctuations in the gold-GLD spread. These insights are valuable for traders, investors, and researchers interested in gold-related investment vehicles.

References

- Federal Reserve FOMC Meeting Minutes, 2024–2025

- Bureau of Labor Statistics (BLS), US Inflation Reports, 2024–2025

- World Gold Council Reports, 2024–2025

- Yahoo Finance, Gold Futures (GC=F) and GLD ETF Historical Data